Division of

Military Retirement Pay - Promotion Enhancements

© 2018

Brian Mork, Ph.D. [Rev 2.26]

Home •

Site Index • Wiki • Blog

Update: The 2017 National

Defense Authorization Act changed the definition of "Disposable

Retirement Pay". The effect duplicatesarguments advocated here since 2010 -

one coverture fraction for time or points, and a second coverture

fraction for rank/longevity or salary. However, as of January 2018,

phone calls with DFAS

paralegals confirm the only type of divison they accept for

post-NDAA2017 cases is the Hypothetical Method. This is DFAS implementing of the laws intent. The

Hypothetical Method percentage they calculate is applied to the old

definition of DRP to have the same effect. Otherwise, the

discount is double-applied:

once by the ratio of hypothetical salaries and once inside the

definition of DRP. When the marriage

starts after the military career,

or with multiple spouses, the Area Method is still the only way to

equitably calculate the marital asset. Additionally, the dual

covertures in the Area Method can accomodate both the intent and letter

of the new law. For more

information, see the web page tutorial on the

USFSPA amendment in the 2017 NDAA law. .

Update: The 2017 National

Defense Authorization Act changed the definition of "Disposable

Retirement Pay". The effect duplicatesarguments advocated here since 2010 -

one coverture fraction for time or points, and a second coverture

fraction for rank/longevity or salary. However, as of January 2018,

phone calls with DFAS

paralegals confirm the only type of divison they accept for

post-NDAA2017 cases is the Hypothetical Method. This is DFAS implementing of the laws intent. The

Hypothetical Method percentage they calculate is applied to the old

definition of DRP to have the same effect. Otherwise, the

discount is double-applied:

once by the ratio of hypothetical salaries and once inside the

definition of DRP. When the marriage

starts after the military career,

or with multiple spouses, the Area Method is still the only way to

equitably calculate the marital asset. Additionally, the dual

covertures in the Area Method can accomodate both the intent and letter

of the new law. For more

information, see the web page tutorial on the

USFSPA amendment in the 2017 NDAA law. .

Introduction

This page deals with the issue of dividing

military retired pay in divorce cases when the military person may be

promoted after the divorce. For more general issues, please see a

different page about Area Method

division

of military retirement pay, or specifically division

of

Reserve military retirement pay.

Military retirements are a significant benefit, earned by both women

and men. As of March 2011, there were more

than twice as many military women divorcing

than men. Among enlisted, the military women divorce rate is

about 3x that of men. The overall military divorce rate in 2011

is

64%

higher

than it was in 2001. Dollar value of a military retirement in 2012

dollars range from $945,000 for an E-7 to

$2,800,000 for an O-8. Military

divorce is a significant social

issue

affecting both sexes.

This web page includes:

Growing Consensus

The issue at hand is whether the marital asset must be calculated so

that any action after the marraige does not chagne the marital asset as

expressed in constant year dollars.

Objective parties have weighed in on the issue of promotion

enhancements and it is finally being done properly with statutory

law. Six examples:

- In 1988, the Michigan Appellate court (Kilbride v. Kilbride) said, "..the

pension for distribution in a divorce proceeding is only that value

which accrued during the course of the marriage. Any accrual of

value before or after the marriage may not be considered.

Furthermore, the decisions of the parties following the judgement of

divorce must not affect the value of the portion to the nonemployee

spouse." This case is normally cited to use a coverture

fraction. However, the Kilbride case had no post-divorce

promotions. The quoted logic makes it clear that a calculation

method must not attempt to divide promotion enhancements earned after

the divorce.

- A 2001 United States Armed

Services Committee report to Congress concludes that retirement pay

increases attributable to promotions after a divorce and additional

time served by a military member after a divorce are the member’s

separate property:

“Assets

that accrue subsequently are the sole property of the party who

earned them. Post-divorce promotions and longevity pay increases are to

military retired pay (which is a defined benefit plan) what

post-divorce accruals and contributions are to private, defined benefit

and defined contribution plans.” (page 71)

- In

a 2001 Master's Thesis from the Army Command and General Staff

College. "As far back as April 1995 DOD published a proposed rule

to amend the Code of Federal Regulations, Title 32, Section 63.2. This

rule would base the award to a former spouse on the member's rank and

years of service at the time of divorce. Although [neither] the Code of

Federal Regulations nor the U.S. Code was amended to include this

proposed rule, DOD recognized that post divorce increases in rank

should only be apportioned to the service member."

- In 2005, the Florida

Third District Appellate Court reversed

(case 3D04-1468) and

directed that promotion enhancements are not divisible because Florida

law considers assets acquired after the dissolution to be non-marital

and not subject to distribution. Section 61.075(5)(a), Fla. Stat.

(2003). The circuit court gave the former wife a portion of the former

husband’s military retirement pay without expressly excluding

contingent, future post-dissolution increases. The appellate court

reversed because the overbroad language of the trial court allowed the

former wife to receive promotion enhancements post dissolution.

- In 2009, a Michigan

Skelly v Skelly Appellate reversal of the trial court affirmed that

that if work effort is required after divorce to get or keep a benefit,

it is not a marital asset and are not to be divided even if

monies were received before

the divorce. They also stated that this was an "issue of

first impression for this Court." See the side-by-side text comparison

on the webpage discussing statutes and

case law.

- On 5 May 2012, a new Oklahoma law

implemented the 2001 Federal recommendations. SB1951

Section 3(F) states:

"If

a

state court determines that the disposable retired or retainer pay of a

military member is marital property, the court shall award an amount

consistent with the rank, pay grade, and time of service of the member

at the time of separation."

- On 28 October 2013 the Pennsylvania House Democratic Committee

held hearings on HB1192 which follows the

Federal recommendations:

"If

the court determines that the disposable retired pay or retainer pay

of a military member is martial property, the court will be required to

calculate the amount consistent with the rank, pay grade and length of

service of the member at the time separation."

- In 2017, the National Defense Authorization Act

includes a

provision mandating that promotion enhancements outside of divorce will

not be divided. See H.R 4909 Sec. 625 and S. 2943 Sec. 642 and

Sec 641 of the final reconciled bill. This is in response to a

Department

of Defense report to the Armed Service Committes of Congress, which

recommended this as an equitable change. The Senate bill text says,

"In

calculating the total monthly retired pay to which a member is entitled

for purposes of subparagraph (A), the following shall be used:

(i)

The memberís pay grade and years of service at the time of the

court order.

(ii) The amount of pay that is

payable at the time of the memberís

retirement to a member in the memberís pay grade and years of service

as fixed pursuant to clause (i)."

while the House bill text says,

“[member

entitlement] is to be determined using the member’s pay grade and years

of service at the time of the court order, rather than the member’s pay

grade and years of service at the time of retirement, unless the same’’

Depending on whether a military career

extends before a marriage or after a marriage, this could reduce

payments to either of the spouses. A

2017 NDAA USFSPA

educational presentation (slideshow pdf) is available.

Attorney Mark Sullivan ripped into the proposed law via an

American Bar Association

white paper. Mr. Sullivan's paper is

against military, inciting sexist views that spouses are all females

being taken advantage of. It has three fundmental flaws

inconsistent with Mark's reputation as a national expert: 1) he creates

a strawman statement that a fixed

benefit will be forced on spouses "fixed and locked in time like a fly

encased in

amber", where the truth is a percentage formula is how the law

would be implemented, 2) he claims that COLA will not be paid to

ex-spouses with a resultant "stampede" of court cases, while, in fact,

COLA is paid to both parties for any

percentage method, and 3) he invokes constitutional arguments that the

Federal government should not affect divorce law and therefore

(hypocritically) asserts the

Federal USFSPA law affecting divorce should be left alone. You

can download a more complete

rebuttal

to Mark

Sullivan's / ABA's cheeky piece against the 2016 NDAA law or a

shorter 2-page paper that just

demonstrates

the 2017 NDAA division formula.

In addition to these opinions, consider the injustice

if a

military member is re-married and the first spouse gets half of

promotion or longevity enhancements earned while married to a second

spouse.

It is difficult to argue that a prior divorced spouse deserves what the

second

spouse contributes toward! Letting a divorced ex-spouse reach into the

future and take what they contributed nothing toward is damaging to a

silent

third

party that has no voice in the legal system.

The rest of this web page argues that promotion enhancements after

divorce are not to be divided with an ex-spouse. This page

supports that should be done,

not how to do it.

Simple

methods to implement this idea are introduced elsewhere:

- The Area

Method page. (a.k.a. Dual Coverture Value) which can handle all

situations.

- The Dual

Coverture method (calculated from time and rank), which can handle

more life situations such as duty before

marriage or multiple spouses.

- The

DFAS Hypothetical [basepay] Method (benefit for ex-spouse is calculated

on hypothetical assumption that promotions did not happen)

One last point of clarification: I was asked to assist during a court

case in 2016 where the expert witness for opposing counsel tried to separate promotion from longevity.

Remember we are dividing

dollars, not rank and not years. The DFAS Hypothetical Method is

about hypothetical base pay.

It is not about hypothetical rank (only) or hypothetical longevity

(only). In order to use a base pay chart to look up dollars, both

rank and longevity years must be used together to choose the proper row in the table. In order to

forestall the waste created by this argument that models reality in a

logically impossible way, know that whenever I refer

to the promotion enhancement, I

mean the enhancement of base pay when using an increased rank and/or

increased longevity year count.

Promotion

Enhancements Require a Dual Coverture

A military retirement is different than civilian retirements because it

is calculated from two values,

using 1) amount of service (points

or duty days), and

2) rank & longevity (value of

each point).

Reference 10 USC 12739, and 10 USC 1406 or 1407. The formula is

essentially the same for an Active Duty or Reserve retirement:

- retirement monthly pay = 2.5% * (years service credit) * (basepay

for rank) (Active Duty)

- retirement monthly pay = 2.5% * (points/360) * (basepay for rank)

(Reserve)

The two factors of service credit and rank are independent, and cannot

be

captured in one

number or fraction; a proper military coverture fraction is the result

of two

mathematical

fractions multiplied together: the time or Duty Fraction, and the Rank

Fraction. If only one ratio were used, the

non-military spouse would keep benefit all military promotions outside

the marriage. This damages a future spouse (innocent third party) and

is not equitable to the military member. In reverse, if duty

before marriage is to be excluded as a pre-marital asset with only one

ratio, the military member would benefit from excluding the early years

at a higher rank. Using a

single time fraction can damage EITHER party.

Unlike time-only-based

promotions where promotions and longevity comingled into

one coverture ratio, military promotions are always unique,

special, or outstanding based on stratification of promotion

applicants, limited quotas, deployment records, testing results,

advanced school

degrees, competitive formal performance reports, and professional

military education. In the military, simply having longer longevity does not earn a promotion.

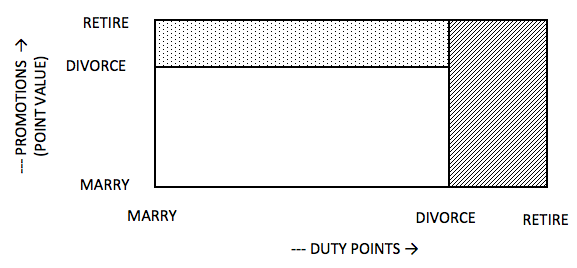

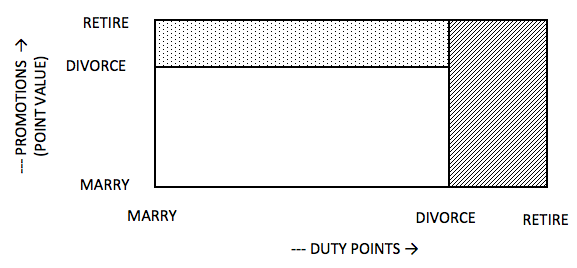

One way to visualize the situation is a 2-dimensional area like the

area of carpet in a room. The total value of the retirement asset

is represented by the area of the diagram. Coverture

fractions separate different sections for division or non-division.

A single coverture fraction divides the diagram left and right at the

time of divorce, giving the slant hash portion only to the military

member and making both the clear and dotted sections part of the

marital asset (subject to division). And so the problem is

obvious: the dotted portion,

which was earned due to actively earned promotions after the divorce,

must also be set aside from division. This is what common sense and the

quotes above describe, and what a second

coverture fraction does.

During the 2001 Congressional study, two prominent national attorneys

argued for dividing promotion enhancements after divorce (a.k.a. treat the dotted section as a marital asset). Perhaps

their motivations match one QDRO

generating business

which would have you believe dual coverture is too difficult and

therefore equity should be abandoned for simplicity. Common wisdom

says, "follow the money" and I sadly realize that keeping things

complicated pays the bills of both the attorneys and the QDRO

factory.

In fact, anybody who can figure out the area of a room floor can divide

military retirement assets equitably. You simply multiply the total

retirement by two fractions to calculate the marital asset -- not

rocket science. Although the Dual Coverture

method can handle most situations, the precise details for every life

situation are

discussed in another web page describing the Area Method.

The 2001 Department

of Defense

report to Congress (which considered input from dozens of National

organizations, bar associations, and others) says:

"[Giving

ex-spouse a portion of

post-marriage promotion benefit] of military retired pay is

inconsistent with the treatment of other marital assets in divorce

proceedings—only those assets that exist at the time of divorce or

separation are subject to division. Assets that are earned after a

divorce are the sole property of the party who earned them. Congress

should amend the USFSPA to base all awards of military retired pay on

the member’s rank and time served at the time of divorce. [It is proper

to] base all awards of military retired pay on the member’s rank and

time served at the time of divorce. This provision should be

exclusively prospective. The pay increases attributable to promotions

and additional time served should be the member’s separate property.”

(page 4)

“Assets that accrue subsequently are the sole property of the party who

earned them. Post-divorce promotions and longevity pay increases are to

military retired pay (which is a defined benefit plan) what

post-divorce accruals and contributions are to private, defined benefit

and defined contribution plans.” (page 71)

"Congress should amend the USFSPA to provide that

all awards of military retired pay be based on the member’s rank and

years of service at the time of divorce. [After

NDAA 2017, this is now a Federal mandage.] Current laws do not specify

one way or the other.] This provision should be

exclusively prospective. For example, if a future divorce occurs when

the member is an O-4 (i.e., Major/Lieutenant Commander) with 14 years

of creditable service, the award of military retired pay must be based

on that rank and time served. That the member retires as an O-6 (i.e,

Colonel/Captain) with 24 years of service is irrelevant to the award of

military retired pay as property. (page 71)

"The pay increase attributable to the promotions and additional

time served should be viewed as the member’s separate property.

[emphasis added] However, as a matter of equity, the former spouse

should benefit from

increases in the pay table applicable to the O-4 grade. Thus, as the

pay for an O-4 with 14 years of service is increased due to increases

in the pay table, so too is the value of the allocation to the former

spouse. The objective in this regard should be to provide the former

spouse, on a present value basis, with approximately the same amount of

retired pay that he or she would have actually received had payments

begun on divorce. DFAS should include a formula in its recommendations

that could be used by parties who divorce while the member is still on

active duty. (page 72)

In response to the last sentence quoted above, DFAS published in their attorney

guide

what is known as the

"Hypothetical [Basepay] Method" formula to divide the retirement.

Unfortunately, the Hypothetical Method requires onerous mathematics and

has other limitations such as inability to handle militarly work before

marriage.

After years of researching legal cases, Mork published the Dual

Coverture Value method in 2012 and the Area method

in 2015, which are plug-n-play replacements for Hypothetical Method in

the situations the Hypothetical Method can be applied, plus they handle

all other life situations.

Mork's

methods are better than Hypothetical for several

reasons:

simpler, more lucid, and broader

application while backward compatible with all existing methods. For

example, Hypothetical gives COLA annual increases to an ex-spouse

during the years between divorce and retirement, while giving military

paychart raises to the military member. Why the inequity?

If COLA just happens to be the same

as

military pay increases, Hypothetical, DCV, and Area Method all

give the same answer. If not, one spouse or the other is being

mistreated. If you are not

willing to use DCV or Area Method, that begs issues of intentional

inequity and judicial bias -- why should one spouse intentionally get

more time-value

adjustment when

it's trivial to treat spouses equally?

The Report's recommendations are also manifest in statutes (e.g.

Oklahoma SB1951

Section 3(F)) and court precedence. The only way to do what is written in the

quote above is the DFAS Hypothetical Method

or the one of Mork's methods.

If you are interested, you can download numerical examples, comparing

single time coverture (such as the California Brown method) to the Area

Method. To insist single coverture is done "because that's the

way we've always done it," reflects dishonor on a court system capable

of much better.

Promotion

Enhancement Can Be Done Simply

Misunderstandings by one New Jersey appellate court reveal how

tangled the simple meaning of "during a marriage" can become.

The NJ court required the military member to prove that the

ex-spouse did not contribute to promotion earned after the

marriage

This is a twisted standard of proving something didn't

happen rather than having the ex-spouse demonstrate they did contribute

to work after the marriage. Mr.

Troyan published an opinion

that things have gotten more

complicated for his business of preparing divison orders because the

final result of the NJ

Appellate opinion allowed promotions after a marriage to not be

divided. Contrary to Mr. Troyan's opinion, formulaic

determination is now much more unified and

coherent than ever before, based on DCV

methods. Multiplying the total retirement by two fractions to

calculate the marital asset is not rocket science.

In order to reduce confusion, and because he did not reply to multiple

invitations for conversation, I dedicated

an entire section of a white

paper response to Mr. Troyan to

quantitatively establish that a promotion does or does not increase

the marital asset. Here are

short summaries from the much longer white paper, summarizing the

character of promotion enhancements:

- Chronological sequence

of dates are the presumed determination of what is "during a

marriage".

Sans compelling reasons why not, dates should be used. If

something accrues chronologically after marriage, it wasn't during a

marriage.

- Promotion is obviously required

for retirement promotion

enhancement, but is not sufficient

to cause it. Making a promotion manifest into an increased

retirement

payment requires 3 years of duty after

gaining the increased rank, so an ex-spouse would have to contribute

for 3 years after the promotion to contribute to the retirement

enhancement (vice

the promotion, per se).

- Promotions are special, unique, and competitive. Only a

small

portion of individuals can accomplish this by specific, difficult,

pro-active effort. Promotion enhancements are not the same as passive

investment income

increases due to passage of time. "Earning interest" is NOT the

same as "Earning retirement". Bluring this issue has been repeatedly

done by

Mark Sullivan and propagated into the legal system because of his

association with the American Bar Association and the Reserve

Officer Association.

- The military retirement system is mathematically precise and

explicit. It is easy to quantify and separate events of a

person's career. Values are not comingled.

- Prior

application for promotion during (or soon after) the

marriage and NON-selection for promotion is prima

facia evidence that what a prior spouse contributed was not sufficient

for promotion. Often times, a military member is promoted on subsequent

attempts, demonstrating that it's the solo effort or shared

effort of a later

spouse that

made the promotion possible. Honestly, the stress of a divorce can be

enough to handicap and military member and forestall or prevent a

promotion!

- Promotion

enhancements after divorce taken by a first spouse will

deprive a second spouse of what is rightfully their contribution. Like

any other investment, if a spouse divests themselves of the marriage,

they should not expect returns after divesting. When stock shares are

sold, the second owner gets the returns.

Congressional

Report Silences Dissent

Regardless of these qualities of promotion, some continue to argue

against the Dual Coverture and Hypothetical

methods. The DoD congressional report

tried to show generosity toward these disagreements.

They summarized the best arguments to divide promotions

after marriage

(first paragraph page 59). The arguments come up short because

they are technically faulty and rely on confusing

an

unfamilar audience. Here are the three bad arguments and

responses:

- "Military member would not have attained final rank but for

contributions made by former spouse during marriage. Promotion is based

on married years." This

argument is vacuous because all things later in life are "based on"

prior life and that is an insufficient test to classify anything as a

marital

assets. See below

or another another

web page

to read additional rebuttal to the "based on" argument. The phrase "based

on" conjurs up a concept of dependecy

or comingling, while slipping in words that have no legal definition.

Gaining a new benefit "based on" history is NOT

the same

thing as shared effort creating that benefit. More indicitive of

this argument's hypocrisy is that when military duty is done before

marriage, everybody freely allows the marital asset to be "based on"

prior solo effort without compensation to the solo effort.

Example 1 - What if a military pilot later got a civilian pilot

job "based on" pilot training and experience received during married

military

years. This does not allow the ex-spouse to divide a retirement

from the civilian pilot job.

Example 2 - A person will never attain age 50 but for the first 18

years, yet a parent can't obligate a child's earnings later in life for

this

reason.

Example 3 - What if the ex-spouse wrote a book based on being married

to a military member? That would not be possible "but for" the

military member's contribution during marriage, and it's definitely

"based on" the military members contribution. However, this would not

allow the military member to receive part of the book proceeds because

they didn't help write the book no matter what it was based on.

Example 4 - In many cases there would be no military retirement

"but for the fact that the military person works more years past the

divorce, so why should the ex-spouse get anything? USFSPA itself

dismantled this based on argument when used by the military member, so it should also

be refused for the non-military

member.

Example 6 - The claim that "a military member's non-divisible

benefit is calculated from the ex-spouse's divisible points (and

therefore cheating the ex-spouse)," is a moot point of

perspective. If true, the reverse is equally true: "the

ex-spouse's benefit is calculated from the military member's

non-divisible points (and therefore cheating the military

member)." It works both ways! "Calculated from" is simply a

mathematical necessity, not a threshold criterion of divisibility, and

it is not

an appropriate test for a marital asset.

Example 7 - Divorce decrees use phrases like "earned during the

marriage" or "accrued during the marriage". Words have

important legal maning. Division orders (which are legally required to

follow the divorce decree) must not introduce vague phrase or fabricate

new dependencies such as "base on".

Example 8 - The duty credit or points (in case of Reservists) are like

a basket emptied of value at time of divorce by virtue of dividing it

to the parties. Just like picking a garden, if one party goes out

and puts more value (promotion enhancement) back in the same baskets

after divorce, that additional value is not a marital asset.

Example 9 - If a second spouse contributes during promotion years, how

can it be equitable to attribute their effort and their half of the

promotion enhancements to the first spouse?

- "Increasing

the denominator of the coverture fraction reduces the

share

of the former spouse." This argument is faulty because the share

does NOT reduce.

The statement relies on confusing the

words - "share" "portion" "fraction" "dollar" "percentage", etc.

One must clarify what is really

being said. When increasing the

denominator, does the marital

asset change value? No. Does the

spousal dollar amount

decrease? No. Does the fractional percentage decrease?

Yes, because the overall retirement increases to exactly offset.

For example $50 is 1/2 of $100, but $50 is 1/3 of $150. The

increasing denominator reduces the share of the total retirement, and ensures the

proportion of the marital asset does not change (except time-value of

money, which both parties would receive for all time after the date of divorce).

This is not a capricious quid-quo-pro "smaller piece of bigger pie"; it

is a precise and necessary math function to precisely preserve the

marital asset as expressed in constant year dollars.

- "Spouse must wait until member retires to receive payments and

should

be compensated." This argument obliquely implies that only

the

ex-spouse has to wait. In fact, due to Federal Law both parties

have to wait to

receive anything--and both ARE

compensated with Hypothetical and Dual

Coverture methods, which recognize rank changes. This argument

attempts to establish a windfall for the ex-spouse when the

military member doesn't even have that right yet! Michigan

Appellate Court wrote that that

"dividing [potentially] zero retirement is not in error," implying that

it would not coerce a military

member to continue doing duty. All

methods

discussed in these web pages DO compensate both parties, so this

argument is a specious distractor. Only the Mork methods (DC,

DCV, Area Method) compensate

both parties the

same regarding time-value of money.

Hypothetical method compensates one person with COLA during the

"waiting months" and

compensates the other with military salary increases. There is no

reason

choose Hypothetical Method over Dual Coverture Value unless one is

intentionally choosing inequity.

Based-On Arguments

Even when the DOD report discussed above slammed down the "based

on" and "but for" and "built on a foundation" argument, it continues to

cause preferential damage

to

military members. There is no legal basis to suggest "built a

foundation" is a sufficient threshold of determining a marital asset

and the argument is an offense to any division order that awards

division "earned during" or "accrued during" the marriage. The

asymmetry in how the argument is used

belies its purpose to hurt military members. For example, Courts

write:

"The sacrifices of both parties’

incidental to the defendant’s military service during the marriage laid

the foundation for the defendant to potentially enhance his pension by

achieving promotions after the marriage has dissolved [and therefore

promotion enhancements should be divided]."

In comparison, when the roles are reversed (when the marriage effort is

based on a prior solo portion of a military career), you'll never see a

court write,

"The solo sacrifice of the defendent

laid the foundation for the dual sacrifice during the marriage and

potential to enhance the pension by achieving promotion during the

marriage, therefore spousal award of the marital asset should be less

than half."

Also consider if a person remarries and a second spouse actually does

sacrifice with the military member during the time of promotions.

Would anybody suggest half the promotion enhancements belong to the

first spouse rather than the second spouse?!

This concept is specifically critiqued in the Sullivan rebuttal

available in the references section below.

The debate is not about how to divide

a marital asset because military career records make it easy.

Rather the issue is whether something is a marital asset in the first

place.

If an enhanced promotion benefit was "earned" or "accrued" without

spousal contribution after the divorce, it is not a marital asset no

matter what it is "based on" or how it is calculated. A court must

first do a determination if the promotion enhancement is a marital

asset.

The phrase "based on" is legally vague and obscures good

judgment. Attorneys and court pride themselves on precise

language. Any use of this word in military retirement

divorce proceedings should be replaced with the more precise "accrued

during" or "earned during" or "calculated using". If an

ex-spouse wrote a book based on being

married to the other person, book earnings are not divided

even though it taps into and uses time of marriage or uses the marriage

as a foundation and opens the potential of writing a book.

In my experience, clarity and transparent language helps military

members. To be intentionally vague and confusing dishonors our

legal system.

Even USFSPA, which created the ability to divide military retirments,

was created to put down the "based on argument". McCarty v. McCarty was the US

Supreme Court pivotal case out of the 1980s that prevented division of

military retirements in part because the benefit was "based on" the

military member doing more solo work after marriage. However, USFSPA declared that "based on" was an insufficient legal

threshold and not a unitary disqualifier. Retirement that had been

partially "earned or accrued" during the marriage was therefore

partially a marital asset. If "based on" future work isn't enough to prevent division, then "based on" past work is not enough to cause division.

Post-divorce work is not comingled; it

is easily separate by legal statute, mathematics, and practicality. See the community post titled "Value of Half or Half the Value?".

An attorney pressed me on an important question regarding a

Reserve retirement when there are promotions after the marriage.

Question: "If a marriage earned 4400 points, and half (2200) are given

to the ex-spouse, then how come the ex-spouse doesn't get to keep all

promotion enhancements (before during and after the marriage)

associated with those points?

ANSWER 1: The root of the question is false because it assumes point

value is all or nothing; it is not. While retirement points earned

during the marriage contain marital asset value, it is an error to

assume they contain 100% marital asset value and anybody asserting this

should be required to prove it. Said another way, it is

an error to assume the ~first~ earning of value (be it solo before

marriage,

or during marriage, or solo after marriage, or during second marriage)

is the ~only~ contribution of value. Points are not unity awards

to

one person or the other. Points are an accounting instrument like

a

401(k) account number. It's the VALUE of the points that is divided,

not the points themselves. For example, if you divide the value of a

401(k), great. But employee contributions put back into that

account

after the marriage are not divisible just because the account number is

the same. The account itself is never awarded - only value IN the

account. For example, military Thrift Savings Plan retirement accounts

are handled this way, and military retirement points are the

same. One

must calculate what value in the points are marital asset and Federal

military

retirement formulas make this easy with rank/longevity coverture

fractions.

ANSWER 2: The language of court orders and DFAS example formulas give

50% of marital asset (4400 points). They do not award all the

value of half (2200) the points. Look at your court order.

It names 4400 points. It does not name 2200 points. There

is a big difference between "the value of 2200 points" and "half the

value of 4400 points," These are NOT the same because the value of a

point changes during the years, whereas a divorce settlement must

determine value of the points at the divorce valuation date, NOT at any

other random time before or after the marriage. This can only be

accomplished/calculated if we talk about "half value of points" not

"half the points".

ANSWER 3: Most courts and attorneys are familiar with civilian

retirements which depend on a single variable like "years with the

company" similar to "points earned in the military". The military

retirement formula, however, is not the same. A military retirement is

calculated from TWO variables: basely (rank/longevity) and amount

of duty.

monthly retirement check = 2.5% * (basepay) * (points/360)

Point counting alone can measure the amount of duty, however, the

points must be divided in the other dimension to allocate the proper

time when rank/longevity was accrued. The two contributing factors are

separate and distinct, proven by the retirement formula (which has two

variables) and the the fact that a basepay chart table lookup must use

rank/longevity. To commingle points and rank/longevity will

damage one party or the other, and they should not be commingled

because the military retirement formula itself does not commingle.

ANSWER 4: Doing this wrong damages a second spouse who has a

constitution right to not be damaged. Consider a 21-year military

career that was 7 years solo at low ranks, 7 years with Spouse 1 at

middle ranks, and 7 years with Spouse 2 at highest ranks. Awarding

point ownership (instead of value) would make all three marital assets

the same, which is incorrect. With a military retirement, the effect of

rank is mathematically broken out and not commingled. When the

first spouse divested themselves at middle rank like an ex-dividend

date of a stock, the future owner gets the future higher-rank

gains. If you sold your Bitcoin in 2016, you don't get the 1600%

gain of 2017!

Clarifying Logic

There are multiple sequential steps to dividing assets that a court

must do. If any one of these steps are skipped, court orders are

susceptable to successfull appeal, assuming proper documentation was

submitted during the original court action. Here are the steps:

- Determine if something is a marital asset. USFSPA allows, but

does

not direct, a court to consider military retirement as a marital

asset. All of the military retirement

is a marital asset only if all

of the military career was during the marriage.

- Determine

asset values as of some date. This is

typically

the date of separation, the date of filing divorce, or the date of

final divorce order. Determining marital asset value is the

entire point of a retirement coverture fraction. An enhanced

retirement value does not manifest or acrue until 3 years of continued

duty after a promotion date.

- Decide

how to divide the marital asset. Many courts simply go

with 50:50 of the marital asset. USFSPA forbids the military member to

be left with less than 50% of the retirement, even if there are

multiple spouses.

USFSPA

allows a military retirement to be divided as a marital asset, and

almost always divorce decrees will specify to divide only "...the

portion

earned during the marriage" because it's kind of obvious that all the

rest of the retirement is

not a marital asset. Portions earned outside the marriage that

are quantifiably separate retirement point value do not get past the

first step. Only the portion of the retirement actively earned during

the

marriage is divisible.

It is worth nothing that the Area Method

allows proper

handling of military duty and promotion before and after the marriage,

along with

any other combination of multiple marriages, divorces, and military

duty. No

other method, including the DFAS Hypothetical Method, is capable of

this.

Here are some Q&A

that might help.

Q1: Aren't promotion enhancement based on prior contribution by

spouse?

A1: No. Initially, the U.S. Supreme Court forbid division of any

military retirement that required additional solo work contribution by

the military member after divorce. Subsequent USFSPA law allows for

division of military retirement because of co-mingling of duty

dates. There is no co-mingling for a promotion

enhancement. The marital asset is numerically and quantifiably

separable with simple math, yielding the single number percentage

required by DFAS. Blurring dates is done only by someone

trying to take more than is equitable.

Q2: Isn't the promotion enhancement based on prior rank and duty, which

the spouse contributed to?

A2: No. I think you mean "calculated from" instead of "based on."

Just

like some DFAS divisions are calculated from Federal COLA numbers, the

promotion enhancement is calculated from solo duty credit and dual duty

credit, plus other numbers. Service credit points are not owned

by anybody

and division of value calculated from points is based on *earning*

points not *calculating* with them.

To believe otherwise is analogous

to saying 401(k) contributions done years after a marriage are

divisible because the 401(k) account existed during the marriage, and

is thus "based on" marriage activity. The

divisible portion of the marital asset must not go up or down (as expressed in constant year dollars) because

of anything accomplished by either spouse after the divorce. Making

the conclusion even stronger, two additional points are relevant:

- Often a person is declined promotion for one or more

attempts,

and if that occurs after an ex-spouse stops contributing, it's even

more clear that the ex-spouse contribution did not accrue a promotion.

- If a promotion happens after divorce, it's nigh impossible to

claim the spouse continued to contribute during the required 3

additional years

vesting after promotion.

Q3: The military member is building on the value of points earned during the

marriage, so shouldn't the former spouse get a portion of the increased value of those points?

A3: The marital asset (dollar value of

the points) was already

divided. The points themselves, stripped

of their value by the division order, are not to be

encumbered. They are like a basket or a bank account. Any

post-divorce effort

to put additional value back into the empty baskets is not to be

divided. That additional value does not comingle, nor increase,

nor decrease the previous value - the only thing that changes the

marital asset value at time of divorce is COLA increases while both

spouses wait for disbursement of the asset. The military member

should be

free and clear to use what

they are left with after the divorce in order to improve life for

themselves after the divorce. Any division order implements this

truth for 401(k)s and IRAs and military TSPs. It should also be

done for the traditional retirement value, also. See https://www.facebook.com/military.divorce.retirement.division/posts/981378512036088 for a convincing discussion of the analogy.

Note that Federal law NDAA 2017 mandates this for any divorce after

2016 because courts were consistently damaging military members

inappropriately.

Q4: Won’t the military member’s income be higher because of duty

days earned during the marriage?

A4: No. Points or duty days have no value in and of

themselves. Use of the points at higher rank was accrued 100%

after the divorce. The litmus test laid out by the Michigan Kilbride

Appellate Court for a proper division formula is that nothing either spouse does after the

divorce should increase or decrease the marital asset (as expressed in constant year dollars).

"We

believe that an equitable distribution under the pension statute

requires that the method employed reflect the fact that the value of

the pension for distribution purposes in a divorce proceeding is only

that value which accrued during the course of the marriage. Any accrual

of value before or after the marriage may not be considered.

Furthermore, the decisions of the parties following the judgment of

divorce must not affect the value of the distribution of a portion of

the pension to the nonemployee spouse."

Q5: Right, but if pre-existing points were not present or the prior rank

was not present, then the benefit would be lower for the military

member, wouldn’t it?

A5: If the prior points were not present or rank was not present, then

benefits would be lower for both parties. It’s problematic to

hypothesize about non-historical non-truth. Instead, we’re asking

the court to make a distinction about what DID happen - between how a

benefit is calculated and how it was earned or accrued. As a

precedence, consider that the Skelly Appellate court clarified that

even after a benefit is paid and in the bank during a marriage, it is

not a divisible marital asset if it was earned and the right to keep it

was accrued after the divorce. We are asking the court to honor

the intent of divorce law by dividing what was accrued during the

marriage. Tallies of points and rank cannot be enjoyed as a

retirement benefit by anybody and have no value. The USE of

points and rank creates retirement benefit. The right to USE for promotion enhancement was

100% accrued after the divorce.

Dissent of Two

Nationally Known Attorneys Fails

A few incalcitrant attorneys in the area of military family law

continue to publish against the DoD report recommendation and the

NDAA2017 law. In

public forums,

they argue that

promotions enhancements earned outside the bounds of the marriage

are marital assets and should be divided. IMHO, this is a huge

disservice to military officers, and I cannot understand why the

Reserve Officer Association advocates and promotes one of the

attorneys, who has publicly opined in this way against military

members. If

you are a ROA member, write the chief ROA legal counsel and ask.

Additionally, the ABA Family Law section has declined multiple attempts

to provide balanced content instead of continued railings agains the new NDAA 2017 law.

North Carolina attorney Mark Sullivan disagrees

with the Armed

Services Committee Report, the Oklahoma legislature, Michigan and

Florida appellate courts, the

Department of Defense, and the NDAA2017 law. He believes that

retirement contributions made years after a divorce should be

divided as marital assets. Mr.

Sullivan's critique of the DoD report is available from the Military

Committee of

the American Bar Association (ABA) Family Law section.

Sullivan's arguments do not hold water; see

my rebuttal memorandum in the references below. Mr. Sullivan's

position is analogous

to saying 401(k) contributions done years after a marriage are

divisible because the 401(k) account existed or was opened during the marriage, and

is thus "based on" marriage activity.

In fact, military members can now do a 401(k)-like retirement

called TSP. Because of the juxtaposition, it will be interesting

to see where Mr. Sullivan positions himself. There seems to be only 3

choices:

- Promotion enhancement and TSP contributions done outside the

window of marriage are not marital assets. This would require a

change in his published belief and arguments before court about

retirement enhancements.

- Promotion enhancements and TSP contributions done outside the

window of marriage are marital assets and should be divided. This

is intolerably in conflict with hundreds of other TSP/401(k) divorce

cases where

contributions made after divorce are never considered marital property.

- If a military member increases their retirement with work and

merit promotions after the marriage, it IS divisible. But if they

take pay from the work and promotions, and stick it into the TSP then

it is NOT divisible. This seems intolerably hypocritical, and

capriciously negates utility of one type of retirement savings from the

military person for the rest of their life.

There is more. Another document is a 1999 Official

ABA position

paper by Nevada attorney Marshal S. Willick

which was sent to the DoD committee as input for the committee to

consider. There are no documents available on the ABA web page taking

the other position, and they have declined to host or link to my

material.

Sullivan's document has foundational errors that may have started as

simple confusion. In contrast, Willick's

work is openly caustic toward military

advocates,

using phrases like "proposals floated by extremists" to describe the

position

of the Federal DoD Report to the Armed Services Committee of the U.S.

Congress. Willick makes misleading and sexist

statements like "the longer the husband worked after divorce, the

smaller the wife's portion became. The court accepted the wife's

position that to 'lock in' the value of the wife's interest to the

value at divorce, while delaying payment to actual retirement,

prevented the wife from 'earning a reasonable return on her

interest.'"

Mr. Willick's claims are

technically faulty, while at the same time he emotionally appeals for

personal trust in his ABA paper. For example, the above red

herring claim about "smaller", "locked in", and "no return on interest"

is exactly opposite of the

well-research Congressional Report, and is discredited in a rebuttal

to Mark Sullivan's editorial. It appears that Mr. Willick

engages in tit-for-tat inflammatory

language with the USFSPA Liberation

Support Group, such as that found in Willick's

5 December 2011 public web posting.

Ironically, on page 3 of his December 2011 paper, Willick honors the

recommendation to Congress to implement what became USFSPA. He

should also honor the DOD recommendations to Congress quoted above that

respect post-marriage military effort belonging only to the military

member.

Mr. Willick claims:

"[Using rank at time of divorce], if

the member delayed the spouse's receipt of military retired pay by

choosing to remain in service (accruing further increases in rank and

length of service), then the spouse obtains some compensation for that

delay, in the form of a few more dollars per month when the benefits do

begin, even though the former spouse's share is an ever-smaller

percentage of the benefit. This is sometimes called the "smaller slice

of the larger pie." I have personally checked the math, and in terms of

lifetime collection, the best that a former spouse can do under the

time rule, in normal circumstances when the member continues service,

is to almost break even."

"I have independently verified the mathematical effects of the various

approaches taken by the state courts. Unless Congress is willing to

also mandate that the states adopt rules requiring payments to spouses

at each members' first eligibility for retirement, regardless of the

date of actual retirement, I estimate that a "rank at divorce" proposal

would result in a reduction in the value of the spousal share by at

least 13%."

Mr. Willick is incorrect:

- He claims a member delays an ex-spouse's receipt of money by

"choosing to remain in service"? Would Mr. Willick have a court

order a military member to stop serving their country and become

unemployed? When the military member stays in the military, the

ex-spouse rides on

the coat-tails of a

guaranteed return on investment in the form of COLA and/or military

raises--same as what the military member themselves receives. Mr

Willick appears surprisingly blind to this fact. Both members do

not have a choice to "cash out earlier".

- An

ex-spouse's dollar portion of the marital asset does NOT

become smaller

when a military member keeps working. In fact, an excellent

litmus test of a good division is that the ex-spouse portion expressed in constant year dollars does not

go up or down based on post-divorce work of either person.

Willick's arguments fail this test. Note ex-spouse's value is NOT

locked

in at the time of the divorce, but rather increases due to COLA or

military pay chart raises. COLA or military pay charts ARE a reasonable

return on interest.

- The

ex-spouse does not get only "a few more dollars per month.." but gets

COLA raises or military pay chart raises every year. To give any more

annual

passive increases to the ex-spouse would give the ex-spouse MORE

increases than the

militiary

member themselves get as passive increases. He identifies the

supposed problem of a former spouse "breaking even". Since the

former spouse does not contribute after the divorce, they are suppose to break even, not get more!

- "Smaller

slice of the larger pie" is faulty, manipulative

phrase.

After a divorce, the marital asset does NOT get larger so the the

"larger pie" phrase is inappropriate, and the

ex-spouses fraction of the marital asset does NOT

get smaller. For

clarify, the proper phrase is, "The marital asset should not get larger

or smaller based on anything spouses do after marriage." The Dual

Coverture or Area Method or Hypothetical Method are the

appropriate methods to precisely preserve the marital asset value. Willick appeals to

personal trust of his mathematics, but fails

to show the calculations. I go to great detail and show all the

supporting math in documents available in the reference

section below.

- Mr. Willick assures the reader he has personally verified

the

mathematics showing that "rank at divorce" reduces the payments to the

spouse "by at least 13%". This borders on manipulative deceit if

what he means is that when

promotion enhancements are properly

given to the retiree working after

divorce, the ex-spouse fails to get a 13% inequitable wind-fall.

Such manipulative language does not create clarity. I am not sure what

he means because he again does not show the math, and appeals only to

personal assurances. Please see the mathematics

sections of my documents. Go through my math and let me know of any

mistakes you

find.

It's unclear why the American Bar Association published

Willick's inflammatory and technically faulty position paper as a

statement of their official position. Doing so

makes the ABA

distinctly not neutral toward military members. If you believe

the ABA should also make available a different view, please contact

them and ask them to post the rebuttal available in the reference

section below. Any attorney should be able to argue for their

client. However, ABA's and Willick's and Sullivan's position are

not in defense of a particular client. The position is taken a

priori, in

public, advocating to invade military retirement actively earned

outside of the marriage. IMHO, there is no way I would hire them if I

were a military

member. My true hope is that they are honestly confused, and

perhaps my simple yet powerful Area Methods

will change their viewpoints.

The pay arm of the military (DFAS) implemented DoD Congressional Report

recommendations in

their official

DFAS Recommendation to Attorneys document in the form of the

Hypothetical

Method. The Area Method referenced at the bottom of

this page gives

the same numerical result (coverture fractions are the same), and is a

lot simpler to understand.

Both preserve the ex-spouse dollar

amount as a military member works more, and then, on

top of that, both methods award COLA or military wage increases for all

years

after the

divorce, up to retirement, and all pay chart increases after

retirement. If you want to understand the Hypothetical Method, see step

(D)(2)(b), page 9, of the DFAS recommendation to

attorneys document, in the Resources section at the bottom of this

page. Or, if you want to understand the simpler Dual Coverture method,

see the calculations I personally have published, as

documented in the

Attorney Instructions for Division of Reserve

Military Retirement, also in the references section below. A spreadsheet comparing all 3 methods is available in the Reference section below.

As an example of an attorney damaging Reservists who earn promotion

ehancements before or after the marriage, Mark Sullivan's divorce questionnaire

page provides for promotion after the divorce for Active Duty

retirement (Paragraph (a)(iv)), but does not offer that possibility for

a Reservist. Mr. Sullivan is incorrect to write "ONE of the

following

methods must be used"

(capitalization his). It

is not true that

something on his list must be selected. The only thing DFAS

requires is a fixed award (dollar amount per month) or a percentage

award (percentage per month). It's disingenuous to pretend the

method to generate the percentage must come from his list. As I

said above, I would not

hire him to represent a military member unless he first changes his a

priori bias against military.

Willick's comments were done before the DoD report. Sullivan's comments

are

after the detailed DoD report to Congress was completed. Sullivan's

credentials are

top-notch. However,

credentials cannot dispute facts. He's declined several times to

interactively talk through these issues with me. If you are a

military member, before you hire him, ask

him, "If promoted after divorce, should the ex-spouse share in the

enhanced promotion value?" Sullivan's arguments represent

the

epitome of

misunderstanding passively

accrued vs. actively earned benefits, causing tremendous detriment

to

military members.

Conclusion

I

am open to interactive discussion to clarify any of these issues with

spouses, attorneys or others of the legal community. I continue

to strive for equity for both parties of a divorce, integrity exhibited

by the attorneys, and lucid clarity for the courts. Feel free to

contact me if I can help your legal situation.

- DFAS "Guidance on Dividing Military Retired

Pay", March 2014, 25 pdf pages

with bad formatting, 121 KB pdf. (DFAS.mil,

increa

copy).

- Older copy April 2012, 20 pgs, 119

KB pdf. (DFAS.mil,

increa

copy).

- Older copy "Attorney

Instructions - Dividing

Military Retired Pay", April 2001,

19 pgs, 74kb pdf. (DFAS.mil,

increa

copy).

- DoD Report to Committee on Armed Services of the US Senate and

House of Representatives, 2001. (Defense.gov,

increa

copy) (84

pgs, 279kb pdf)

- Attorney

Instructions - Division of Reserve and Active Duty

Military Retirement, Mork, 2012. (increa

copy)

- Marshall

Willick position paper to DoD Report committee. 1999.

- Marshall Willick position paper

December 2011.

- Mark

Sullivan editorial regarding the DoD Report to Congress. 2001.

- Division

of Military Retirement

Promotion Enhancements Earned After Divorce, Mork, 2012 - a

rebuttal to Mark Sullivan's 2001

editorial against the Armed Services Committee report.

- Appellate Court of Illinois Marriage

of Wisniewski, 675 N.E.2d 1362, 1369 (Ill. Ct. App. 1997).

- Oklahoma state SB1951, signed

into law 5 May 2012 (6 pages).

- "Simple

Division Orders after New Jersey's 2011 Decisions" - a

reply to Mr. William Troyan web posting.

- Numerical comparison of single

coverture vs. DCV.

- Mark

Sullivan's August 2016 "hit piece" against the 2017 NDAA amendment.

- Supporting

the 2017 NDAA law, rebutting Mark Sullivan's paper.

- Demonstration

of the 2017 NDAA law division formula.

- National Defense Authorization Act (NDAA) amendment to US Former

Spouses Protection Act (USFSPA) - a

slideshow primer.

The

shell of this document was created

using AbiWord

under the Linux

Gnome

desktop. Content was edited using Kompozer.

© 2017

Brian Mork, Ph.D.

Update: The 2017 National

Defense Authorization Act changed the definition of "Disposable

Retirement Pay". The effect duplicatesarguments advocated here since 2010 -

one coverture fraction for time or points, and a second coverture

fraction for rank/longevity or salary. However, as of January 2018,

phone calls with DFAS

paralegals confirm the only type of divison they accept for

post-NDAA2017 cases is the Hypothetical Method. This is DFAS implementing of the laws intent. The

Hypothetical Method percentage they calculate is applied to the old

definition of DRP to have the same effect. Otherwise, the

discount is double-applied:

once by the ratio of hypothetical salaries and once inside the

definition of DRP. When the marriage

starts after the military career,

or with multiple spouses, the Area Method is still the only way to

equitably calculate the marital asset. Additionally, the dual

covertures in the Area Method can accomodate both the intent and letter

of the new law. For more

information, see the web page tutorial on the

USFSPA amendment in the 2017 NDAA law. .

Update: The 2017 National

Defense Authorization Act changed the definition of "Disposable

Retirement Pay". The effect duplicatesarguments advocated here since 2010 -

one coverture fraction for time or points, and a second coverture

fraction for rank/longevity or salary. However, as of January 2018,

phone calls with DFAS

paralegals confirm the only type of divison they accept for

post-NDAA2017 cases is the Hypothetical Method. This is DFAS implementing of the laws intent. The

Hypothetical Method percentage they calculate is applied to the old

definition of DRP to have the same effect. Otherwise, the

discount is double-applied:

once by the ratio of hypothetical salaries and once inside the

definition of DRP. When the marriage

starts after the military career,

or with multiple spouses, the Area Method is still the only way to

equitably calculate the marital asset. Additionally, the dual

covertures in the Area Method can accomodate both the intent and letter

of the new law. For more

information, see the web page tutorial on the

USFSPA amendment in the 2017 NDAA law. .